News

June 17, 2025—Effective the first pay period in July 2025, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 1.84% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 2.3% for the one-year period ended March 31, 2025 (the Plan's measurement date). The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program.

January 20, 2025 – Statement of Pension, Retirement, Annuity, and Other Income information slips will be mailed in late February to all pensioners and those who received disability benefits in 2024.

May 23, 2025 - 2024 Annual Statement of Benefits have been sent out for delivery.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your estimated retirement dates, and your designated beneficiaries.

Invested in helping you

If you have questions about your Annual Statement of Benefit, talk to one of our staff today. Our staff are available Monday to Friday, 8:30 a.m. to 4:30 p.m..

June 2024—Effective the first pay period in July 2024, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 2.32% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 2.9% for the one-year period ended March 31, 2024 (the Plan's measurement date). The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program.

May 7, 2024 - Annual Statement of Benefits will be delivered to all active Members in early June.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your estimated retirement dates, and your designated beneficiaries.

Invested in helping you

If you have questions about your Annual Statement of Benefit, talk to one of our staff today. Our staff are in the office Monday to Friday, 8:30 a.m. to 4:30 p.m..

February 14, 2024 – Statement of Pension, Retirement, Annuity, and Other Income information slips will be mailed in late February to all pensioners and those who received disability benefits in 2023.

July 7, 2023 - On March 7, 2023 the Government of Manitoba announced an increase to the Basic Personal Amount tax credit from $10,855 to $15,000, effective January 1, 2023. Pensioners/long term disability members received a lower basic personal amount for the first six months of the year, so a prorated basic personal amount of $19,145 will be applied to future pension/long term disability payments for the remainder of 2023. As a result, beginning July 14, 2023 many pensioners’/long term disability members’ net deposits will be higher due to the reduction to provincial income tax beginning with their July 14, 2023 deposits.

It is important to note, beginning January 1, 2024, the basic personal amount will go down from $19,145 (2023 prorated basic amount) to $15,000 and the provincial income tax will go back up.

December 19, 2023 – The Government of Manitoba is increasing the Basic Personal Amount to $15,705 on January 1, 2024. Some pensioners’ and long term disability members’ net deposits might decrease in 2024 compared to their deposits at the end of 2023.

Background

On July 14, 2023 the Government of Manitoba increased the Basic Personal Amount to $15,000 retroactive to January 1, 2023. As a result, a prorated Basic Personal Amount of $19,145 was applied to pension and long term disability payments for the remainder of 2023.

June 13, 2023—Effective the first pay period in July 2023, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 3.44% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 4.3% for the one-year period ended March 31, 2023 (the Plan's measurement date). The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program.

May 13, 2023 - Annual Statement of Benefits will be delivered to active Members in early June.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your possible retirement dates, and your designated beneficiaries.

Invested in helping you

If you have questions about your Annual Statement of Benefit, talk to one of our Pension and Benefits Officers today. Our staff are in the office Monday to Friday, 8:30 a.m. to 4:30 p.m..

May 12, 2022 - Annual Statement of Benefits will be delivered to active Members in early June.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your possible retirement dates, and your designated beneficiaries.

Invested in helping you

If you have questions about your estimate, talk to one of our Pension and Benefits Officers today. Our staff are in the office Monday to Friday, 8:30 a.m. to 4:30 p.m..

January 27, 2023 – Statement of Pension, Retirement, Annuity, and Other Income information slips will be mailed in late February to all pensioners and those who received disability benefits in 2022.

June 16, 2022—Effective the first pay period in July 2022, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 5.36% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 6.70% for the one-year period ended March 31, 2022 (the Plan's measurement date). The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program.

Individual statements will be mailed the first week of July 2022, following implementation of the COLA increase.

March 15, 2022 – Our office is open for in-person validation of forms and appointments with staff.

To avoid congestion in our reception area, please book in-person appointments in advance by calling 204-986-2516.

For now, face masks continue to be required inside the building at 317 Donald Street and while visiting our office on the fifth floor.

If you would prefer not to visit in person, our staff continue to be available to meet by telephone or Microsoft Teams. Please call us to schedule a meeting.

Drop off of documents can be done any time during regular business hours (8:30 a.m. to 4:30 p.m. Monday through Friday) using our no-contact secure drop box available outside our office door on the 5th floor of 317 Donald Street.

The Winnipeg Civic Employees’ Benefits Program is committed to providing a healthy environment for our staff and Members to conduct business. If you are feeling ill, experiencing symptoms of COVID-19, or have been in contact with someone who has COVID-19, please do not enter our workplace.

January 2022 - Statement of Pension, Retirement, Annuity, and Other Income information slips will be mailed in mid-February to all pensioners and those who received disability benefits in 2021.

June 15, 2021—Effective

the first pay period in July 2021, pensioners of The Winnipeg Civic Employees' Pension Plan will

receive a 1.76% Cost-of-Living Adjustment (COLA) on their pensions.

This

increase is based on 80% of Canada's Consumer Price Index (CPI), which was 2.20%

for the one-year period ended March 31, 2021 (the Plan's measurement

date). The level of COLA granted in a particular year is tied to the funded

status of The Winnipeg Civic Employees' Benefits Program.

Individual

statements will be mailed the first week of July 2021, following implementation

of the COLA increase.

February 2021—T4A Statement of Pension, Retirement, Annuity, and Other Income information slips will be mailed in mid-February to all pensioners and those who received disability benefits in 2020.

May 18, 2021 - Annual Statement of Benefits will be delivered to Active Members in early June.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your possible retirement dates, and your designated beneficiaries.

Online Pension Estimator

Using our

Online Pension Estimator you can estimate your retirement pension anytime using the data from your most-recent

Annual Statement.

Invested in helping you

Our staff are in the office Monday to Friday, 8:30 a.m. to 4:30 p.m. In keeping with Manitoba Health recommendations, our office is not open to the public at this time. If you have any questions about your

Annual Statement of Benefit, please contact us by telephone or email at:

Telephone: 204-986-2516

E-mail: wcebp@winnipeg.ca

October 30, 2020 - The Canadian Actuarial Standards Board has developed and adopted revised actuarial standards that will affect the way Commuted Values are required to be calculated.

This change will only affect lump sum benefits payable under the Pension Plan. It does not affect Members who choose to receive – or who currently are receiving – a bi-weekly pension from the Plan.

A Member Notice with detailed information including important deadlines has been mailed to active Members (i.e., employees, including Disability Plan claimants) and Members entitled to a deferred pension.

May 23, 2020 - Annual Statement of Benefits will be delivered to Active Members in early June.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your possible retirement dates, and your designated beneficiaries.

Online Pension Estimator

Our Online Pension Estimator will project your pension for you on-the-spot using the personal information you enter from your Annual Statement.

Invested in helping you

Our staff are in the office Monday to Friday, 8:30 a.m. to 4:30 p.m. In keeping with Manitoba Health recommendations, we are practicing social distancing and restricting in person appointments. If you have any questions about your Annual Statement of Benefits, please contact us by telephone or email at:

Telephone: 204-986-2516

E-mail: wcebp@winnipeg.ca

June 10, 2020—Effective the first pay period in July 2020, pensioners of The Winnipeg Civic Employees' PensionPlan will receive a 0.72% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 0.9% for the one-year period ended March 31, 2020 (the Plan's measurement date). The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program.

Individual statements will be mailed the first week of July 2020, following implementation of the COLA increase.

June 2019—Effective the first pay period in July 2019, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 1.52% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 1.9% for the one-year period ended March 31, 2019 (the Plan's measurement date). The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program.

Individual statements will be mailed the first week of July 2019, following implementation of the COLA increase.

February 2018—T4A Statement of Pension, Retirement, Annuity, and Other Income information slips will be mailed in mid-February to all pensioners and those who received disability benefits in 2017.

April 2019 — The Winnipeg Civic Employees' Benefits Program (the Program) achieved a positive rate of return of 0.65% for 2018, despite challenging financial markets (particularly in the final quarter).

This rate of return exceeded our policy benchmark (the Program's long term policy asset mix) by 2.11%, and ranking it in the top 25% among larger pension plans in Canada.

Despite challenging financial markets in 2018, the Program maintained a healthy four-year annualized rate of return of 6.73% as at December 31, 2018.

An actuarial valuation of the Program, which will determine the overall funded status, is currently underway. The results of the valuation will be published in the Program's Annual Report later this year.

Information regarding the recruitment of a Member Trustee was provided in a Notice to Retirees, which was mailed to the Plan’s pensioners, survivor beneficiaries and deferred members at the end of June 2018.

June 2018—Effective the first pay period in July 2018, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 1.84% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 2.3% for the one-year period ended March 31, 2018 (the Plan's measurement date).

Final preparations are underway for the mail-out of individual statements (of pension payment and deduction details) to each of the Program's pensioners. These statements will be mailed the first week of July 2018, following implementation of the COLA increase.

The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program. The level of funding within the Program which supports COLA is expected to vary over time, and will be affected by both future Program experience (especially investment experience) and the portion of future contributions that are allocated to finance COLA. The portion of contributions allocated to fund future COLAs is expected to be sufficient to finance COLAs for pensions for service on/after September 1, 2011 at a rate equal to 50% of the annual percentage change in CPI. Accordingly, in the absence of emerging surplus or other positive Program experience, the level of COLA can be expected to gradually decline in future years to 50% of the annual percentage change in CPI.

We are invested in helping you. If you have any questions about your COLA, please contact us.

June 2017—Effective the first pay period in July 2017, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 1.28% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 1.6% for the one-year period ended March 31, 2017 (the Plan's measurement date).

Final preparations are underway for the mail-out of individual statements (of pension payment and deduction details) to each of the Program's pensioners. These statements will be mailed the week of July 4, following implementation of the COLA increase.

The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program. The level of funding within the Program which supports COLA is expected to vary over time, and will be affected by both future Program experience (especially investment experience) and future contributions which support COLA. Currently, contributions are expected to fund COLAs related to pensions derived from service on/after September 1, 2011 at a rate equal to 50% of the annual percentage change in CPI. Accordingly, as has been communicated previously, the COLA rate is expected to gradually decline over time from 80% to 50% of the annual percentage increase in CPI.

We are invested in helping you. If you have any questions about your COLA, please contact us.

March 2018—T4A Statement of Pension, Retirement, Annuity, and Other Income information slips have been mailed to all pensioners and those who received disability benefits in 2017. If you have not received your 2017 T4A, please contact us.

March 2017—T4A Statement of Pension, Retirement, Annuity, and Other Income information slips have been mailed to all pensioners and those who received disability benefits in 2016. If you have not received your 2016 T4A, please contact us.

July 2016—Effective the first pay period in July 2016, pensioners of The Winnipeg Civic Employees' Pension Plan will receive a 1.04% Cost-of-Living Adjustment (COLA) on their pensions.

This increase is based on 80% of Canada's Consumer Price Index (CPI), which was 1.3% for the one-year period ended March 31, 2016 (the Plan's measurement date).

Final preparations are underway for the mail-out of individual statements (of pension payment and deduction details) to each of the Program's pensioners. These statements will be mailed the week of July 4, following implementation of the COLA increase. Please be aware that a disruption in postal services may delay delivery of these statements.

The level of COLA granted in a particular year is tied to the funded status of The Winnipeg Civic Employees' Benefits Program. The level of funding within the Program which supports COLA is expected to vary over time, and will be affected by both future Program experience (especially investment experience) and future contributions which support COLA. Currently, contributions are expected to fund COLAs related to pensions derived from service on/after September 1, 2011 at a rate equal to 50% of the annual percentage change in CPI. Accordingly, as has been communicated previously, the COLA rate is expected to gradually decline over time from 80% to 50% of the annual percentage increase in CPI.

We are invested in helping you. If you have any questions about your COLA, please contact us.

May 2016—Active Members: your Annual Statement of Benefits will be delivered soon.

Final preparations are underway for the mail-out of over 9,000 statements to active Members (i.e., employees and deferred Members). Statements will be mailed before the end of May.

Your Annual Statement summarizes important details about your pension, including how much pension you have earned, your possible retirement dates, and your designated beneficiaries.

Once you have received your Annual Statement, you may wish to visit our Online Pension Estimator. This tool will project your pension for you on-the-spot using personal information you enter from your Annual Statement.

We are invested in helping you. If you have any questions about your Annual Statement of Benefits, please contact us.

OFFICE HOURS: Monday to Friday, 8:30 a.m. to 4:30 p.m.

TELEPHONE: 204-986-2516

February 2016—T4A Statement of Pension, Retirement, Annuity, and Other Income information slips have been mailed to all pensioners and those who received disability benefits in 2015. If you have not received your 2015 T4A, please contact us.

November 2015—Our 2014 Annual Report is now available for download in PDF format. This report highlights the activity of the

Board of Trustees as well as key operational activities of

The Winnipeg Civic Employees' Benefits Program for the year ended December 31, 2014. This report also contains audited financial statements for the

Pension Plan and

Disability Plan.

View the 2014 Annual Report now.

February 2015—A strong stock market and improved bond market resulted in another year of double-digit returns for The Winnipeg Civic Employees’ Benefits Program.

The Program’s investment portfolio achieved a rate of return of 11.0% in 2014.

This is the third consecutive year of strong positive returns since the negative returns experienced in 2011. The Program’s four-year and ten-year annualized rates of return as at December 31, 2014 are 9.4% and 7.2%, respectively.

An actuarial valuation of the Program as at December 31, 2014, which will determine the overall funded status, is currently underway.

Results of the valuation will be published in the Program’s 2014 Annual Report which will become available on this website later in the year.

November 2014—Our new online Pension Estimator tool is now available.

This easy-to-use tool will estimate your pension in real-time using personal pension information you enter from your Annual Statement of Benefits.

If you have your Annual Statement of Benefits handy, you can try the Pension Estimator now.

June 2014—The Winnipeg Civic Employees’ Pension Plan is governed under a jointly-trusteed structure according to the terms and conditions of the Pension Trust Agreement entered into by the City of Winnipeg and the Signatory Unions. The 14-member Board of Trustees of The Winnipeg Civic Employees’ Benefits Program (Pension Fund) is appointed equally by the City of Winnipeg and the Signatory Unions. Of the seven Member Trustees (appointed by Signatory Unions), one Member Trustee is appointed on behalf of the Plan’s pensioners, survivor beneficiaries and deferred members (collectively referred to here as Retirees).

Notice of Expiration of Appointment

Rick Borland has served on The Board of Trustees of The Winnipeg Civic Employees’ Benefits Program (Pension Fund) as the Member Trustee on behalf of Retirees, since January 1, 2007. Mr. Borland’s current term of office will expire on December 31, 2014.

Application Process

Any Retiree who wishes to be considered for appointment to The Board of Trustees of the Winnipeg Civic Employees’ Benefits Program (Pension Fund), for a four-year term beginning January 1, 2015, must follow the application process set out in the Pension Trust Agreement.

Information regarding the application process was provided in a Notice to Retirees, which was mailed to the Plan’s pensioners, survivor beneficiaries and deferred members at the end of June 2014.

April 2014—The Winnipeg Civic Employees’ Benefits Program’s investment portfolio achieved a rate of return of 19.8% in 2013.

This places the portfolio well above the median Canadian pension fund rate of return of 13.8%, ranking the Program in the top 10% of large pension plans in the country for the year 2013.

Positive returns in 2012 and 2013 continue to offset negative returns experienced in 2011. The Program’s four-year and ten-year annualized rates of return increased again in 2013 to 9.3% and 7.1% respectively.

An actuarial valuation of the Program as at December 31, 2013, which will provide more detailed results regarding the overall funded status of the Program, is currently underway.

Results of the valuation will be published in the Program’s 2013 Annual Report which will be available on this website. Anticipated publication date is August 2014.

April 2014—This easy-to-use online tool will estimate your pension in real-time using personal pension information you enter from your Annual Statement of Benefits.

It's packed with great features:

- See how different scenarios—such as retiring early or receiving a salary increase—can affect your basic biweekly pension amount

- View results for all the optional forms of pension and choose the one that is right for you

- Customize your results by adjusting your pensionable earnings for inflation and selecting your own retirement date

A notice will be published to this news page when the Pension Estimator goes live.

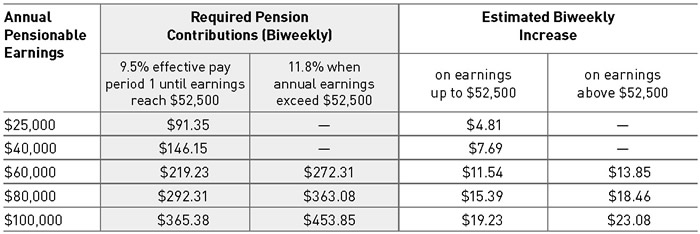

December 2013—As approved by the City of Winnipeg and the Signatory Unions (and previously communicated in July 2011), the rate of contribution to The Winnipeg Civic Employees’ Benefits Program (the “Program”) will increase an average of 0.5% of pensionable earnings effective the first pay period in January 2014. This increase is the fourth and final in a series of increases phased in from 2011 to 2014.

Your pension contribution rate, effective the first pay period of 2014, will be as follows:

- 9.5% on pensionable earnings up to the maximum pensionable earnings under the Canada Pension Plan (CPP); and

- 11.8% on pensionable earnings above the maximum pensionable earnings under the CPP.

For the Program as a whole, this will result in average contribution rates of 10.0% of pensionable earnings for both employees and employers.

Here are some examples of how the increased contribution rate will affect Members at various earnings levels (based on the 2014 maximum pensionable earnings under CPP of $52,500).

December 2013—For your convenience, The Winnipeg Civic Employees’ Benefits Program has arranged for Blue Cross premiums to be deducted from pension payments 26 times per year (biweekly) rather than two times per month. This new schedule will start in 2014.

In September, Manitoba Blue Cross mailed out rate-change notices to pensioners who have Manitoba Blue Cross coverage.

The new rates are effective January 1, 2014, with the first deduction occurring in December.