Retirement

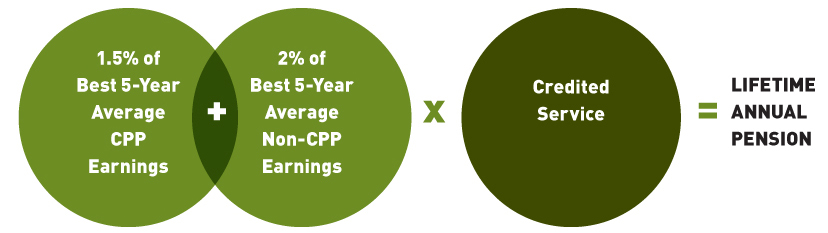

Your pension is based on a formula that takes into account, among other things, your pensionable earnings and your years of

Pension Plan

participation.

Your total benefit is subject to income tax limits at the time your benefit is calculated.

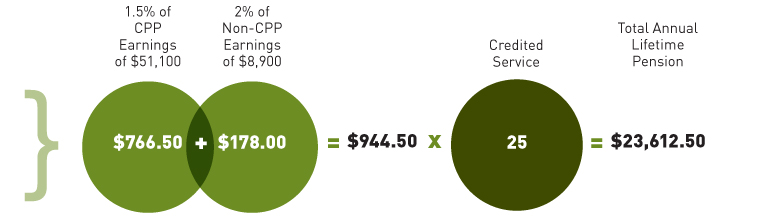

If you are age 65 with 25 years of Credited Service and have best five-year average pensionable earnings of $60,000, your annual pension would be calculated as follows (using a CPP earnings average of $51,100):

You would receive an annual lifetime pension of $23,612.50 or approximately $908.17 biweekly.

Keep in mind that this pension has been calculated on the basis of a single life pension. If you have a Spouse or Common-law Partner at retirement, the Normal Form pension will be reduced to provide a survivor pension for your Spouse or Common-law Partner.

Your Temporary Bridge Benefit

If you retire before age 65, you will receive a temporary bridge benefit equal to:

The bridge benefit brings your total early retirement pension up to 2% of your best five-year average pensionable earnings for each year of Credited Service. The bridge benefit stops when you reach age 65 (when you may be eligible for government benefits).

If you retire before age 65, you may choose the Advance/Recovery option, also known as Old Age Security integration.

The effect of the Advance will be to provide you with an increased pension until you reach age 65. Then, at age 65, for your lifetime, your pension will be reduced by the Recovery amount calculated at the time of your retirement. The amount payable will be actuarially calculated and depend on your age at retirement.

The advantages and disadvantages of this option vary depending on your individual circumstances, making this option one of personal preference.

The Advance and subsequent Recovery amounts are not subject to cost-of-living adjustments.

This option is only available to you at retirement. Upon death, any survivor benefits will be paid as if you had not elected this option. Your Spouse or Common-law Partner may choose the Advance/Recovery option at the time survivor benefits become payable, if they are under age 65 and entitled to a biweekly pension from the Plan.

Choosing when to retire is an important decision—one that can have a big impact on the size of your pension payments. While normal retirement under the Pension Plan is age 65, you may, depending on your age and years of service, be able to retire earlier than that, although all or part of your pension may be reduced to offset the cost of early retirement.

Reductions for early retirement are calculated as 4% for each year (prorated for partial years) that retirement precedes the date you would be eligible to receive an unreduced early retirement pension, based on your Eligibility Service at retirement. This reduction will only apply to pensions earned for service on/after September 1, 2011.

See the Pension Basics section for a summary of your retirement date options.

The Pension Plan currently provides cost-of-living adjustments (COLA) to your pension payments—a valuable feature that helps protect the buying power of your pension over the long term.

The level of COLA granted is tied to the funded status of the Program. In 2023, COLA was paid at a rate equal to 80% of the percentage change in Canada’s Consumer Price Index (CPI) at March 31. However, as of September 1, 2011, contributions will fund COLAs at a rate equal to 50% of CPI, so the COLA granted can be expected to gradually decline over time to 50% of CPI. If the Program’s investments perform better than expected, however, some actuarial surplus may be used to supplement COLA at a rate higher than 50% of the percentage change in CPI.

COLA is applied in the pay period in which July 1 occurs.

If, as of July 1, you have been retired for less than one year, your first cost-of-living adjustment will be prorated.

Cost-of-living adjustments will also be extended to your survivor pension. Pensions derived from Advance/Recovery options, Additional Voluntary Contributions or excess contributions (fifty-percent rule) are not subject to cost-of-living adjustments.